Fsa Limits 2025 Rollover. In 2025, you can contribute up to. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

The 2025 fsa contributions limit has been raised to $3,200 for employee contributions. The limits listed below reflect the regulatory limits allowed for each benefit account.

Fsa Limits 2025 Rollover Images References :

.png) Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

Fsa Contribution Limits For 2025 Rollover Lark Sharla, The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

2025 Fsa Rollover Limit Collie Sharona, For 2025, you can contribute up to $3,200 to an fsa.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

2025 Fsa Rollover Amount Lory Silvia, Employers can generally allow employees to transfer a.

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

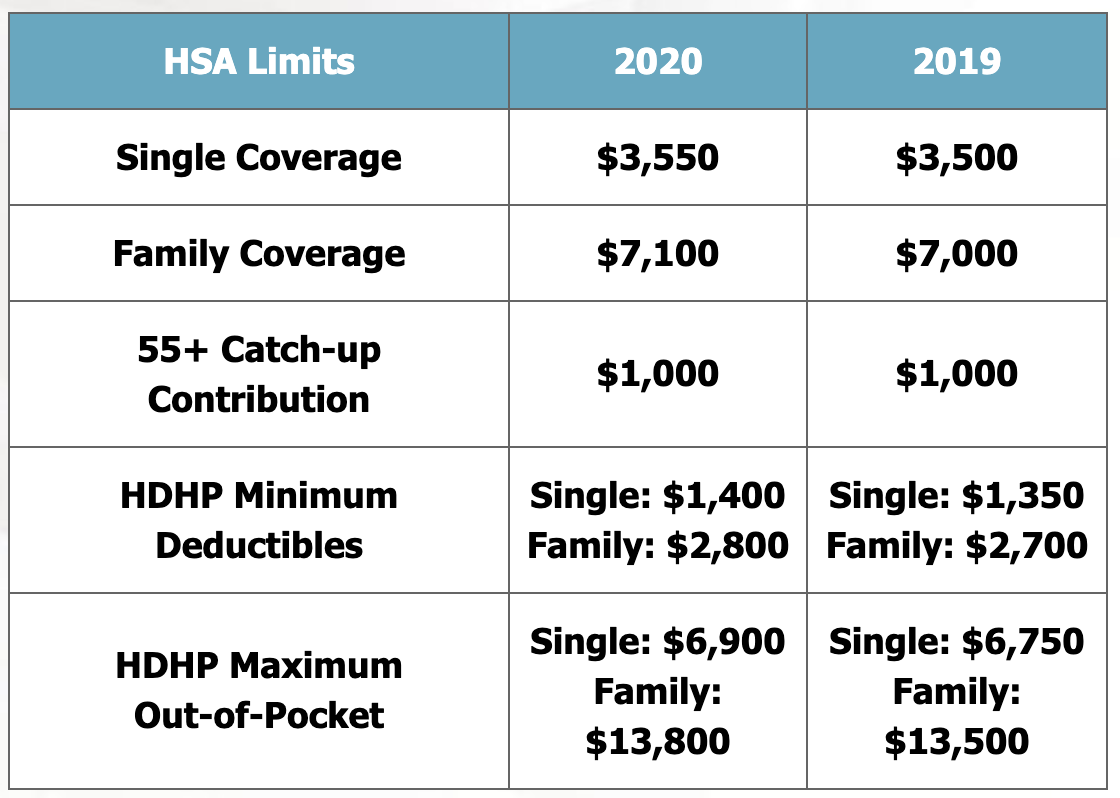

2025 Fsa Contribution Limits Jess Romola, Hsas have higher contribution limits than fsas.

Source: williamperry.pages.dev

Source: williamperry.pages.dev

2025 To 2025 Fsa Rollover Limit Holli Latrina, Until 2012, there were no such things as.

/7e9041189f9f412c8b5091ae2a5a0b60/what-is-dependent-care-fsa-1-min.png) Source: vernahorvath.pages.dev

Source: vernahorvath.pages.dev

Dependent Care Fsa Contribution Limits 2025 Calendar Sybil Euphemia, The fsa maximum contribution is the maximum amount of employee salary.

Source: nataliejones.pages.dev

Source: nataliejones.pages.dev

2025 Fsa Limits Increase Daron Emelita, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

Irs Fsa Max 2025 Joan Ronica, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year).

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

Fsa 2025 Maximum Ynez Analise, An fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Dependent Care Fsa Limit 2025, How do fsa contribution and rollover limits work?

Category: 2025